We are at a critical point in the investment world where passive investment vehicles like ETFs are becoming an increasingly large part of the investor’s landscape. These passive ETFs cling to an index which gets reconstituted periodically with stocks and assets that are widely traded having a higher momentum weightage. The index, in turn, also uses a measure called free float that gives more importance to companies having lower promoter ownership i.e. where increasing portion of the market capitalisation is owned by non-promoters.

In short, the problem in the investment world is that the tilt towards passive ETFs is making the investor orient towards what is traded more and also misaligned with the promoters/founders/owners of the business that they are investing into !

Without going into detail about why this move towards passive ETFs is happening, I would briefly like to state that the lower costs, ease of investing , investment platforms encouraging Do it Yourself(DIY) investing and certain other macro reasons like the shift from Defined Benefit Schemes to Defined Contribution Schemes in the US for retiral funds are probable reasons.

So the question is “How to Active Investment managers position themselvesin order to get the investor back on track to a diversified portfolio ? “

I am sure that this question shall be asked in many Asset Management Firms and Portfolio companies in their board meetings. Also, perhaps what I am going to write below is something that they may already be doing.

The key thesis of my note is that the De-risking and Re-risking cycle is now essential for active investment management and perhaps we should not overemphasise the Buy & Hold approach (advertised by great investors like Warren Buffett but debatably followed by their advocates) because :

- The Valuation cycle of stocks has become longer while the product life cycle for any product launched has become shorter

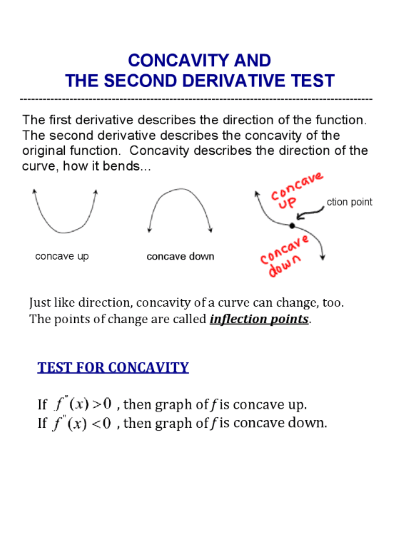

- Rate of change in earnings estimates is becoming less linear and more asymmetric, second derivative. In simple terms earnings estimates are becoming more abrupt with higher swings

- We are moving to an era of lower interest rates and possibly lower returns on equity

- Financial Assets are now an increasingly larger portion of investor assets

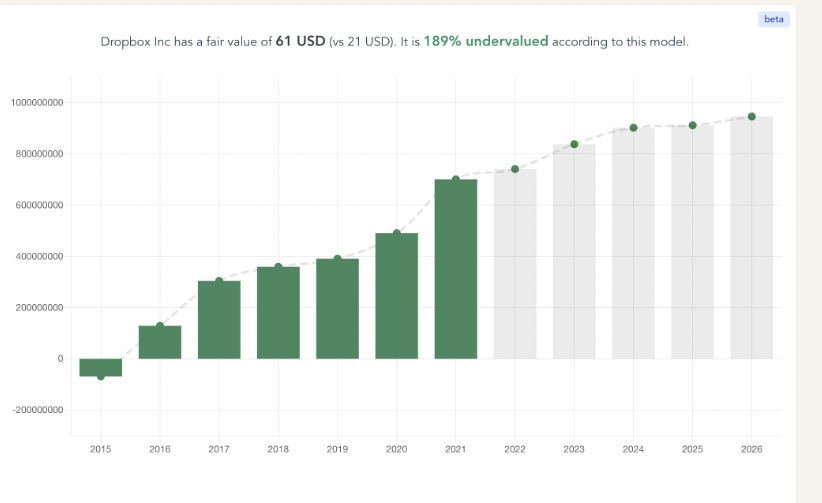

One of the major problematic issues with valuing new-age companies is that their earnings estimates stretch towards a very distant part of the future. I remember one of the analysts covering a new-age Quick commerce delivery firm based the valuation on earnings over the next 10 years. Now that is very far into the future, so until then this valuation is vulnerable to change in technology, change in Govt regulations, vulnerability of promoter exits and many such risks.

In contrast, what we are seeing is that when a company launches a product its life cycle is becoming shorter. And even established companies with leading products considered as moats are now vulnerable to disruption. Case in point being Asian paints in India which over the last 2 years is feeling the heat due to new entrants reducing its moat valuation to a normal valuation. This is because the Growth phase that used to be nearly a decade is now compressing to a lower one or is being challenged by disruptors in the interim.

We are also observing that Financial Assets are becoming an increasingly large portion of individual net worth. Which means the dependence on financial assets for goals like post-retirement income and safety is increasing!

And more and more developing countries now understand that they need to tackle inflation so that they can provide liquidity for their domestic consumption and to lower interest rates for people to buy their first house. This is a welcome change for the world good but yet it shall mean that we are slowly chugging our way towards an era of lower returns. Lower interest rates which was the prerogative of developed nations is now becoming mainstream as nations are more dependent on domestic flows to develop their economies.

Given the above factors we shall be increasingly confronted towards bipolar market where some assets may be overvalued and remain so until they correct swiftly while others might remain undervalued for a long period of time until a change in future estimates makes them rerate upwards.

In addition to sector rotation which is one of the methods to capture the de-risking and re-risking cycle there might be an increasing need for valuation cycle where Investment managers shall have to de-risk and re-risk for investors in order to give better risk-adjusted returns.

If they are able to do this then they shall be in a better position to give a stronger alternative to passive ETFs than a buy and hold strategy. The problem with buy and hold strategy in such a fast evolving business and economic landscape faces challenges of disruption and fast downside adjustments.

In the long term a strategy comprising of good de-risking at higher levels and re-risking at lower levels where we move out of expensive parts of the market and enter less expensive parts of the market is a strong contender for investment performance.

Leave a comment